A Strategic Approach to Risk-Based Wind Development

Investing in a wind farm is an expensive business and can seem to be too risky for more cautious fund holders. Investors are more likely to be interested if it is possible for them to make a better informed decision on the projected financial returns. In particular, the estimate of how much energy the farm is likely to produce is critical to the final funding decision. The well-understood problem here is that energy production can only ever be an estimate during the planning phase, but how certain is that estimate? A new model makes it possible to be much more precise about the level of uncertainty and this should allow potential partners to define, and act on, the comfort zone within which they are prepared to work.

Investing in a wind farm is an expensive business and can seem to be too risky for more cautious fund holders. Investors are more likely to be interested if it is possible for them to make a better informed decision on the projected financial returns. In particular, the estimate of how much energy the farm is likely to produce is critical to the final funding decision. The well-understood problem here is that energy production can only ever be an estimate during the planning phase, but how certain is that estimate? A new model makes it possible to be much more precise about the level of uncertainty and this should allow potential partners to define, and act on, the comfort zone within which they are prepared to work.

By Matthew Hendrickson, Vice President of Energy Assessment, and Francesca Davidson, Marketing Manager, Vaisala Inc. (formerly 3TIER), USA

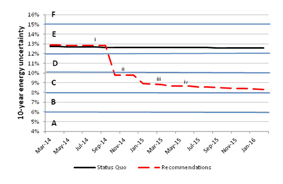

A common complaint directed at wind projects in the later development stages is that not enough has been done to reinforce estimates of how much energy the plant will produce. A confident energy prediction is the result of years of thoughtful planning and due diligence and the wind resource assessment programme is one of the most crucial undertakings of the pre-construction phase. Since the production estimate is usually the most sensitive value driver in a project pro forma, one wonders why the wind resource assessment programme is so often an afterthought. The primary reason for this is that the market has not fully appreciated wind resource assessment risk, mainly because the classic approach to modelling wind resource assessment uncertainty is far too simplistic given the complexities involved, such as measurement error, spatial variation and climate uncertainties. The results can lead to less trustworthy conclusions with no way to truly differentiate between the riskiness of several projects. However, with a sophisticated risk model in place, it is possible to tailor investment much more sensitively to risk. By using future project uncertainty as a barometer, this model allows stakeholders to make decisions today with the single goal of balancing current constraints against a future risk profile preset to the comfort level of the project’s developer and financiers.