Competition across global markets has driven turbine OEMs to introduce new turbines at a faster pace than in the past. The continuous pressure to reduce levelised cost of electricity (LCOE) has led to growth in turbine power ratings, taller towers and longer rotors, and rotor length has become a critical product differentiator.

Competition across global markets has driven turbine OEMs to introduce new turbines at a faster pace than in the past. The continuous pressure to reduce levelised cost of electricity (LCOE) has led to growth in turbine power ratings, taller towers and longer rotors, and rotor length has become a critical product differentiator.

By Shashi Barla, Technology Consultant at MAKE

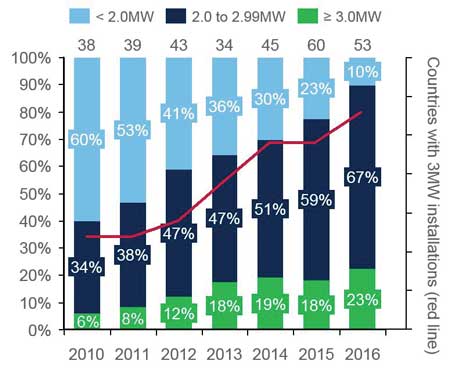

The 3.XMW segment is already increasing penetration in the global markets. In 2016, around 38 countries globally had 3.XMW turbines installed. This segment contributed to around 23% of the total global volume in 2016 compared to 8% five years ago. The 3.XMW product platforms benefit from economies of scale relative to balance of plant, operations and maintenance and logistics costs. As the European onshore wind markets transition to auctions, cost pressure is mounting across the value chain. Turbine OEMs are under pressure to deliver the turbines best-suited to particular wind regimes. Due to limited land availability, OEMs would need to focus on larger power rating turbines to deliver higher annual energy production per turbine at a given wind project. Turbine OEMs are likely to introduce the new 4.XMW platforms for the European markets, and gradually traverse these platforms to other markets as well. The next-generation 4.XMW turbines are expected to be positioned for wind class III regimes with rotor sizes spanning more than 150 metres. Logistics challenges are imminent for onshore blades longer than 70 metres. The industry would have to respond by innovating split/modular blades to circumvent the logistics limitations.

Turbine OEMs are under pressure to deliver the turbines best-suited to particular wind regimes. Due to limited land availability, OEMs would need to focus on larger power rating turbines to deliver higher annual energy production per turbine at a given wind project. Turbine OEMs are likely to introduce the new 4.XMW platforms for the European markets, and gradually traverse these platforms to other markets as well. The next-generation 4.XMW turbines are expected to be positioned for wind class III regimes with rotor sizes spanning more than 150 metres. Logistics challenges are imminent for onshore blades longer than 70 metres. The industry would have to respond by innovating split/modular blades to circumvent the logistics limitations.

The growth in turbine ratings has been the biggest driver for the next-generation offshore turbines. Turbine ratings in the offshore sector have increased significantly over the past five years. Current offshore order backlog includes more than 70% volume in the greater than 5.0MW segment. Leading turbine OEMs are accelerating the research and development on the next-generation offshore turbines with sizes greater than 12MW and with rotor diameters greater than 200 metres. However, the Chinese offshore turbine technology is behind the Western offshore counterpart’s technology. The Chinese offshore market is now graduating from the 4.0MW to the 6.0MW turbine technology. In the Chinese offshore market, a limited potential exists for new development in the sub-4MW segment. The new Chinese offshore turbines are expected to have specific ratings between 250 and 350W/m2.

Turbine OEMs are now deploying a platform approach to product development to accelerate design cycles and leverage common components across products to deliver lower LCOE. Wind class migration is expected on the older turbine suites as new turbines with larger rotors are introduced. This phenomenon would be more common in the turbine-limited markets, while the megawatt-limited markets are expected to see new products with longer rotors due to capacity factors driving the demand for the turbine technology. Overall, fierce competition and pressure to lower LCOE will shorten turbine life cycles/product life cycles.

Next-Generation Turbine Technology

Competition across global markets has driven turbine OEMs to introduce new turbines at a faster pace than in the past. The continuous pressure to reduce levelised cost of electricity (LCOE) has led to growth in turbine power ratings, taller towers and longer rotors, and rotor length has become a critical product differentiator.

By Shashi Barla, Technology Consultant at MAKE

The 3.XMW segment is already increasing penetration in the global markets. In 2016, around 38 countries globally had 3.XMW turbines installed. This segment contributed to around 23% of the total global volume in 2016 compared to 8% five years ago. The 3.XMW product platforms benefit from economies of scale relative to balance of plant, operations and maintenance and logistics costs. As the European onshore wind markets transition to auctions, cost pressure is mounting across the value chain.

Turbine OEMs are under pressure to deliver the turbines best-suited to particular wind regimes. Due to limited land availability, OEMs would need to focus on larger power rating turbines to deliver higher annual energy production per turbine at a given wind project. Turbine OEMs are likely to introduce the new 4.XMW platforms for the European markets, and gradually traverse these platforms to other markets as well. The next-generation 4.XMW turbines are expected to be positioned for wind class III regimes with rotor sizes spanning more than 150 metres. Logistics challenges are imminent for onshore blades longer than 70 metres. The industry would have to respond by innovating split/modular blades to circumvent the logistics limitations.

The growth in turbine ratings has been the biggest driver for the next-generation offshore turbines. Turbine ratings in the offshore sector have increased significantly over the past five years. Current offshore order backlog includes more than 70% volume in the greater than 5.0MW segment. Leading turbine OEMs are accelerating the research and development on the next-generation offshore turbines with sizes greater than 12MW and with rotor diameters greater than 200 metres. However, the Chinese offshore turbine technology is behind the Western offshore counterpart’s technology. The Chinese offshore market is now graduating from the 4.0MW to the 6.0MW turbine technology. In the Chinese offshore market, a limited potential exists for new development in the sub-4MW segment. The new Chinese offshore turbines are expected to have specific ratings between 250 and 350W/m2.

Turbine OEMs are now deploying a platform approach to product development to accelerate design cycles and leverage common components across products to deliver lower LCOE. Wind class migration is expected on the older turbine suites as new turbines with larger rotors are introduced. This phenomenon would be more common in the turbine-limited markets, while the megawatt-limited markets are expected to see new products with longer rotors due to capacity factors driving the demand for the turbine technology. Overall, fierce competition and pressure to lower LCOE will shorten turbine life cycles/product life cycles.

Caption: The market share of onshore turbines greater than 3.0MW is on the rise