As the wind turbine market enters a new era driven by subsidy-free and tax-credit-free cost parity, a new generation of wind energy technology is poised to hit the market by 2020. Markets which are shifting towards a competitive tendering process continue to drive the need for higher annual energy production as well as lower capex, opex and levelised cost of electricity.

As the wind turbine market enters a new era driven by subsidy-free and tax-credit-free cost parity, a new generation of wind energy technology is poised to hit the market by 2020. Markets which are shifting towards a competitive tendering process continue to drive the need for higher annual energy production as well as lower capex, opex and levelised cost of electricity.By Philip Totaro, Founder and CEO, IntelStor, USA

Additionally, new technologies for blade segmentation and turbine erection will unlock previously untapped pockets of the global market, in both space-constrained sectors and areas of complex terrain where conventional technology is not cost-effective.

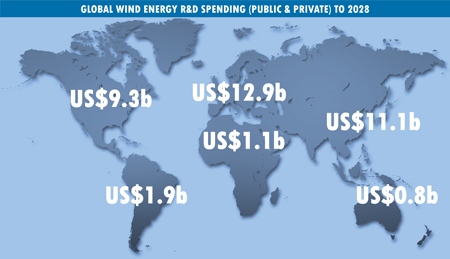

Collectively, the industry will spend approximately US$ 28.2 billion in private R&D by 2028, matched by approximately US$ 8.7 billion in public R&D funding over the same time frame. The private investment represents an industry average of approximately 5.3% of expected revenue and is a significant increase on the average industry low of approximately 2.7% back in 2013.

Regionally, Western Europe, Japan and China will dominate the R&D and technology development landscape, with North America lagging behind a bit due to an unfavourable political environment in the USA and a lack of meaningful government support for climate change technology.

India is potentially emerging as a hotbed of technology development as low costs and government renewables and manufacturing competency development initiatives continue to drive optimism. Gulf Cooperation Council states are also poised to see an increase in spending on renewable energy technologies in general over the next 10 years.

Australia, New Zealand, Singapore, the Philippines, Malaysia and Indonesia are likely to see some modest spending on R&D, as increased wind penetration increases awareness of technology function and development opportunities.

Eastern Europe, Latin America and Africa will see minimal R&D spending in the next 10 years, but they have an opportunity to grow as wind turbine capacity additions increase in those regions and economies recover.

The overall trend in onshore wind technology development appears to be focused on system integration. This is driven by expected growth in distributed generation technologies as well as the increasing cost competitiveness of solar technology. Wind turbine OEMs are shifting focus to go beyond just turbine production and incorporate energy storage and solar into turnkey systems with fully integrated controls.

Digitalisation is also driving a significant portion of technology development as data analytics companies, turbine OEMs, subcomponent suppliers, asset owners and even Independent service providers all look to incorporate asset performance optimisation, asset health management, and even energy trading/balancing capabilities into their product and service offerings.

Nevertheless, in this era of advanced technology development for performance enhancement and levelised cost of electricity reduction, it is also imperative to consider the bankability of new technologies as a guide to the likelihood and timing of commercial adoption. There is a plethora of new ideas stuck in the conceptual and preliminary design phase which appear to be attractive but lack a path and the corresponding investment to become commercially available.

Many major asset owners as well as turbine OEMs and subcomponent suppliers have rekindled their external technology scouting activities, and these efforts are poised to drive mergers and acquisitions to fill specific gaps. The era of ‘Not Invented Here’ seems to be dwindling as technology partnerships and licence agreements are likely to see an increase in the coming years.

There is a significant amount of technology at a mid-range technology readiness (maturity) level (TRL 5–7), and this will require the bulk of the total investment. A total of 46.2% of all innovations have undergone some type of bench-testing, prototype development or field testing, while 23.3% are commercially available or in a pre-series development stage, and 30.6% are still in a design stage.

Companies must continue to focus on R&D spending to ensure their products remain competitive, and governments need to continue to support the companies who make such investments. A strong correlation has long existed in markets that spend the most on R&D and those with the most wind capacity additions. Ultimately, R&D is a precursor to subsequent technology deployment and therefore the cost reductions associated with achieving economies of scale in that market.