Offshore wind technology development has seen an explosion in the past six years. Almost 80% of all the innovation and technology development in offshore wind has been undertaken in that time-frame. The result has led to the global surge in deployment and the significant cost reductions that have been recognised.

Offshore wind technology development has seen an explosion in the past six years. Almost 80% of all the innovation and technology development in offshore wind has been undertaken in that time-frame. The result has led to the global surge in deployment and the significant cost reductions that have been recognised.

By Philip Totaro, Founder & CEO, IntelStor

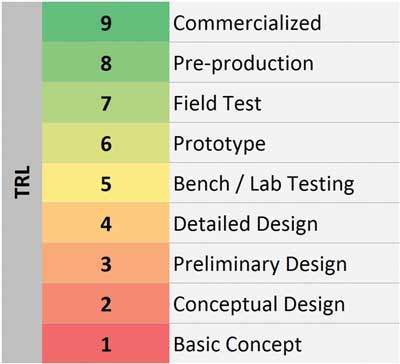

In spite of the progress which offshore wind has made, the innovations which have been developed thus far have not yet fully impacted offshore levelised cost of energy (LCOE) and more technology development can still have a major impact on cost reductions. Tracking those offshore innovations by benchmarking where they lie in the technology maturity scale/technology readiness levels (TRLs) is important for the industry to recognise as we consider the next wave of strategic investments.

Looking at a heatmap of the number of patent filings for offshore technology, it appears that while there are some technologies which are commercially available, a majority (60.3%) of offshore innovations are still in the design and early testing phases of TRL 3–5. Many of the innovations which have the potential for a high impact on the industry through widespread use on multiple projects are still in the testing phases of TRL 5–7. This analysis clearly defines a strategic gap in technologies which are poised to be commercially ready (TRL 8), indicating a need for further investment to push more cost-competitive technology to market.

It will come as no surprise that most of the innovations in offshore are concentrated around foundations as well as vessels. Nevertheless, most of the foundation technologies being proposed are still at a very early stage of development and an analysis of those proposed concepts reveals most do not significantly improve net LCOE.

With a fairly good distribution of innovations spread through the entire breadth of technology, the lack of focus in certain areas such as turbine controls, SCADA and condition monitoring may prove to be detrimental to the offshore industry as it continues to mature. Nevertheless, it is important to note that this analysis represents only those technologies which are offshore-specific, and does not count any dual-use innovations which have also been proposed. Future wind park design, including physical layout, type of electrical system infrastructure and turbine technology, as well as installation and service methods, will benefit from a system engineering philosophy.

As we have seen in the onshore industry, the turbine technology of the future will make a shift towards modular platform architectures to enable site-optimised design. Common platform architecture is set to become more pervasive as companies seek manufacturing and supply chain cost efficiencies and to help further drive down OPEX. The intent to move towards a ‘one size fits all’ foundation solution would enable more manufacturing economies and other ancillary benefits around installation and servicing. It appears that a semi-submersible floater or a tension leg platform are poised to become the most cost-optimal solutions regardless of water depth.

Electrical interconnection has already moved from medium voltage to high voltage, and AC-based to DC-based solutions with some hybrid HVAC and HVDC solutions proposed for the future. Analysis of the early stage technology developments suggests that this evolution will continue as the transition to high temperature superconducting (HTS) cable technology is already under way. HTS is likely to be used in both inter-array and export cables, while more advanced materials that would provide self-healing casings are under evaluation.

The industry is focused on evolving the standard at-sea installation techniques with the use of more quayside component assembly. Conventional vessel solutions will still continue to have their place, although the cost of upgrading to vessels that can handle larger turbines and foundations is likely to be prohibitive versus the shift towards full assembly. This trend works in conjunction with the desired move towards floating foundations noted above.

Condition-based maintenance solutions will become the norm as turbine output optimisation based on remaining useful life, predictive maintenance scheduling and spares demand scheduling all look to have an impact. Remote inspection technologies including optical/video camera-based blade tower inspection, tower climbing inspection ‘robots’, remote controlled aerial vehicles and wireless data transmission technologies will play important roles in the future.

Offshore services may see the use of motherships with crew transfer vessels, as part of a flexible deployment structure. Modular access solutions will benefit from being foundation mounted instead of vessel mounted to reduce vessel dead weight. Offshore technology development appears to be well under way with a significant amount of technology available to further reduce LCOE.