What does it take to be globally competitive in the current wind energy market environment?  As we approach another season of major industry events at which a series of new turbine product introductions are anticipated, the industry can expect those turbines to have a relatively new design philosophy governing their development.

As we approach another season of major industry events at which a series of new turbine product introductions are anticipated, the industry can expect those turbines to have a relatively new design philosophy governing their development.

By Philip Totaro, CEO, IntelStor

Historically, wind turbine design was done on a largely one-off basis, and was based on project siting needs. With smaller organisations and lower production volumes, any turbine sales were welcomed. Then, once a specific turbine design was enabled, other project sites with similar wind class and turbulence characteristics were similarly exploited to provide increased production volume.

However, a side effect of this product strategy approach was that too many turbine designs existed with differing component supply chains at a very low volume. Many of the early stage OEMs who had adopted this design approach and failed to recognise the need for change were forced out of the market due to lack of sufficient revenue and profitability. This had also left many of the remaining OEMs to be regionally focused and lacking a business strategy as well as a product strategy which would be globally competitive.

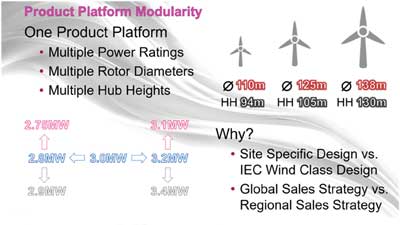

To overcome this scaling challenge, today many Tier 1 OEMs have adopted a product strategy which enables them to provide more site tailored solutions using a common platform architecture. This approach, first conceptualised about five years ago by several Western European OEMs, involves having one turbine design with inherent flexibility to have multiple power ratings and rotor sizes (i.e. power densities) to accommodate the entire array of wind speeds in a specified market.

The net effect of this design philosophy is to make up for levelised cost of energy (LCOE) deficiencies on a turbine per turbine basis with a lowest LCOE solution per product platform. The supply chain efficiencies which are gained from the volume order of sub-components is making a difference in product margins and more than offsetting the sub-optimal LCOE of some of the turbine models in the product platform.

An analysis of currently deployed wind turbines in a given market reveals the extent to which a particular product has been most successful. Most markets have historically had the greatest amount of capacity additions in IEC Class I winds with a subsequent shift towards Class II and III as Class I becomes fully penetrated.

Sales of a specific turbine product will be governed by the pace of capacity additions for a given wind speed. Looking at the current deployment until the end of 2015, there is a discernible product gap at lower power density and power rating of 2.5MW plus.

Nowadays any visible gaps in the product development pipeline are being closed through the development of a product platform which can deliver turbines with multiple power densities (i.e. power ratings and rotor sizes) covering the full range of wind speeds available in a given market.

The evaluation of these gaps against the available wind resource in a specific market will clearly illustrate where a product capability is necessary given the anticipated ramp rate of the market shift from productive, high wind speed sites, to less windy sites. Many companies have been weak in offering a turbine which would be competitive in lower average wind speeds (6–7m/s), as noted above.

The evolution of product offerings in the market will be determined by identification of the mix of products capable of serving the remaining addressable market. Once a market-specific product mix has been evaluated, a similar study must be carried out on a global basis to ensure that sufficient scale of that product platform will provide the OEM with an economically viable platform.

From there, different turbine models can be introduced based upon achieving the right mix of rotor sizes and power ratings to capture a maximum market capacity, thus securing production volumes for an individual OEM. The multiple power ratings and rotor sizes offered in any market will often be focused on capturing the best wind sites in the various speed classes.

A broader understanding of this new design philosophy will be necessary in order for regionally focused companies to become more globally competitive. A new thought process on wind turbine product design and development has already converted some regional companies into global powerhouses in just the past 10–15 years.