Digitalisation and Internet of Things (IoT) technology adoption in the renewable energy (RE) sector is still in its infancy. This immaturity of digital services platforms in RE leaves a major opportunity for revenue growth. The emergence of the RE digital services ecosystem creates a definitive need and opportunity for data-as-a-service (DaaS) and analytics-as-a-service (AaaS), both of which are likely to be a significant revenue driver as part of the overall RE digital services sector. The market for digital services in RE is likely to grow to US$ 89.4 billion by 2030 with annual revenue of US$ 5,3 billion in that time-frame.

Digitalisation and Internet of Things (IoT) technology adoption in the renewable energy (RE) sector is still in its infancy. This immaturity of digital services platforms in RE leaves a major opportunity for revenue growth. The emergence of the RE digital services ecosystem creates a definitive need and opportunity for data-as-a-service (DaaS) and analytics-as-a-service (AaaS), both of which are likely to be a significant revenue driver as part of the overall RE digital services sector. The market for digital services in RE is likely to grow to US$ 89.4 billion by 2030 with annual revenue of US$ 5,3 billion in that time-frame.

By Philip Totaro, Founder & CEO, IntelStor

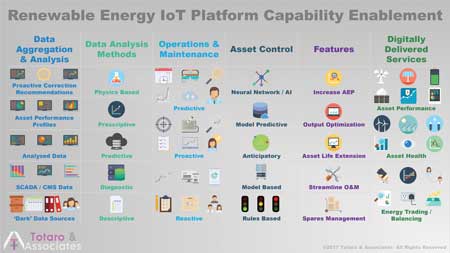

Despite the broadening range of data analytics players competing in the sector thus far, no one company is dominant in the digital services space for wind and solar power yet. Nevertheless, several key companies hold positions which provide them with a desired market-leading position, in spite of the small size of their assets under management. At present, companies who are strong on SCADA and CMS data analytics have been able to leverage that into creating a market perception regarding their capabilities.

In fact, the limited number of data analytics and digital solutions companies in RE is creating an environment with scarce resources. It is anticipated that the early movers in the space will see an explosion of strategic investments or mergers and acquisitions in 2017–18. Approximately 17–20 deals are likely to be announced in the next 18 months as companies cultivate strategic partnerships and acquire assets.

Mainstream IoT companies such as Oracle or SAS will likely enter the RE market at some point, but will require partnerships or acquisitions to expand their knowledge about this segment of industrial equipment. The number of assets under management does not represent as much of an opportunity for them versus wearables or other consumer markets presently where the number of units and the corresponding amount of data is much higher.

Wind, solar and storage OEMs have strengthened their intellectual property (IP) position for key functional capabilities of digital services. These features include leveraging SCADA or CMS data to develop asset life extension models or energy output optimisation park control algorithms. While the innovation landscape is cluttered, there is no dominant company in terms of IP position. Key technologies which have yet to be patented represent some white space for the digital services platform developers.

A lack of standards is hampering digital services platform development as most OEMs forge their own path. This creates a scenario in which significant lobby and marketing resources may be required to convince the industry at large that their solution is the preferred method.

Content licensing will play a critical role in providing a revenue stream for companies operating digital services platforms based on the content created by the platform and their data analytics. It also provides an ancillary benefit of creating an asset class which can be cross-licensed with other DaaS providers to gain access to needed digital content.

Data security is a key growth barrier, comparable in complexity to the standards for communication protocols and interoperability. While IoT data security companies exist and have been receiving the majority of venture capital investment in recent months, this area still requires further definition and development.

The promise which digitalisation holds for RE is to further lower O&M costs as well as provide significant levelised cost of energy (LCOE) value across the entire operational fleet.