Digital content aggregation and data licensing is a well-established business practice for digitally enhanced services in other industries. With the advent of digital transformation in renewable energy, this industry has an opportunity in front of it to share more of the data which companies have amassed on asset performance and health.

Digital content aggregation and data licensing is a well-established business practice for digitally enhanced services in other industries. With the advent of digital transformation in renewable energy, this industry has an opportunity in front of it to share more of the data which companies have amassed on asset performance and health.

By Philip Totaro, CEO, IntelStor

In the market segment of renewable energy related to digitally enhanced services, there are several digital service platform providers and a plethora of asset owners, as well as data analytics companies who will create digital content. This comes in the form of asset performance reports which analyse SCADA and CMS data, and could even combine other data such as end of warranty inspection reports, boroscope images, blade leading edge erosion monitoring and more.

These companies will be generating digital content and data that has direct value for asset performance management or asset health monitoring as well as indirect value in terms of competitive and market intelligence (e.g. identification of component failures, technology usage inside the wind turbine, component pricing data).

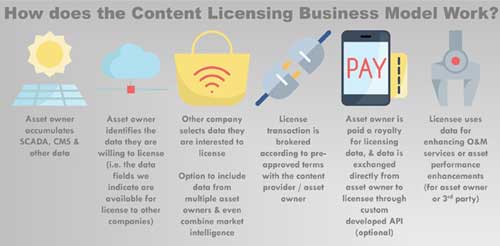

In the past, asset owners, OEMs or independent service providers had no commercial incentive to share their data with other companies. This resulted in most companies stockpiling a significant amount of SCADA, CMS and other data while being very reluctant to share it for fear of liability exposure on warranty claims.

Most companies would likely share more of their data if they were offered a royalty for licensing it, instead of just giving it away to a data pool. Nevertheless, most of these content-generating companies will not consider the monetisation of this indirect value related to market intelligence as a core business for them.

As with the adoption of digital content aggregation and data licensing in other industries, what is required for this data-as-a-service (DaaS) business model to function in renewable energy is an online marketplace for asset health monitoring and asset performance data.

Just like when a Hollywood studio develops a new blockbuster movie and licenses it to movie theatres, television broadcasters and other online digital media platforms like Netflix, Hulu or Amazon, there is a need for a Netflix of energy data in order to provide companies with a commercial incentive to share their content.

The companies who have data to share can anonymously list the data fields they have to license, and potentially a small sample of their data. Interested buyers/licensees would evaluate the content and indicate if they were willing to accept the commercial terms related to the licence, such as duration, exclusivity, jurisdiction of the licence, prohibited uses, etc.

Once the licence transaction is agreed upon, and the licensee provides payment, the content owners share their data through their own application programming interface (API) or some other information sharing mechanism.

Companies can even offset their cost of in-licensing data which they require to build digital models/twins if they share some of their own data.

Content owners retain all rights and title and maintain data security/integrity themselves on their own servers until the transfer of a copy of their data. All transferred content can be digitally tagged and the usage can be tracked by using blockchain/digital ledger technology in order to ensure proper use and licence term compliance.

Asset owners and other data contributors can retain the right to refuse to licence at their discretion by utilising a rules engine. That means asset owners, OEMs and component suppliers who contribute data will only license what they want and to whom they want.

This package of information can then be used to identify sales opportunities for aftermarket components, fleetwide servicing issues, or even performance upgrade opportunities which asset owners did not know existed.

Most asset performance and health monitoring data is highly fragmented due to distributed asset ownership of turbine models from a single OEM among multiple asset owners and operators. This business model would allow data analytics companies or the services divisions of OEMs to pool data from several asset owners or even the asset owners plus other OEMs in order to get a complete picture.

Content licensing is an enabler for multi-brand services, since OEMs who want to perform service on competitor branded assets will require the SCADA, CMS and other data from the asset owner to build the digital asset profile/twin.

In the emerging field of digital services, companies who generate data and companies who want access to it need to employ a content licensing business model in order to recognise the full value of their products and services.