Digitalisation in renewable energy (RE) is poised to become a major opportunity for revenue growth for OEMs, data analytics companies, and data rich asset owners. The emergence of the RE digital services ecosystem creates a definitive need and opportunity for data-as-a-service (DaaS), which is likely to be a significant revenue driver as part of the overall digital services sector. The market for digital services in RE is likely to grow to US$ 91.7 billion by 2027.

Digitalisation in renewable energy (RE) is poised to become a major opportunity for revenue growth for OEMs, data analytics companies, and data rich asset owners. The emergence of the RE digital services ecosystem creates a definitive need and opportunity for data-as-a-service (DaaS), which is likely to be a significant revenue driver as part of the overall digital services sector. The market for digital services in RE is likely to grow to US$ 91.7 billion by 2027.By Philip Totaro, CEO, IntelStor

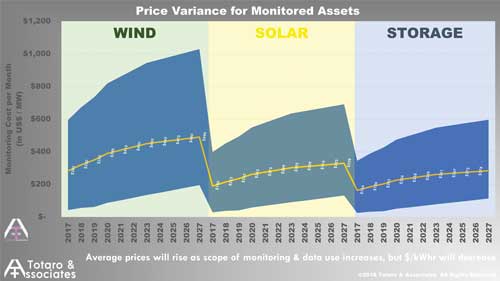

Prices for digitally enhanced services will have the opportunity to rise as the scope of functionality enabled by digital services for monitored assets increases. Wind energy shoots for the moon with a US$ 1,000/MW/month target by 2027, while solar power seeks a more modest US$ 700 and energy storage scales towards US$ 600 as the deployment ramps up.

But in spite of price increases on a $/MW basis, the O&M cost impact on a $/kWh basis is expected to see a decrease of approximately 24% from current levels in the next five years alone, and a 31% decrease by 2027.

Wind energy has certainly been an early mover in the adoption of digital services for fleet performance enhancement or life extension with more than 61GW of assets under contract for at least one monitoring service by the end of 2018. Solar power will likely achieve a target of more than 38GW and energy storage will continue to build with 5.8GW of capacity in the same time frame. The total for all RE digitally enhanced services is set to exceed 100GW of assets for the first time ever later in 2018.

Despite the broadening range of data analytics players competing in the RE sector thus far, no one company is dominant in the digital services space for wind energy, solar power or energy storage yet. Only 24 months ago there were fewer than 50 companies who had publicly announced that they were engaged in digital transformation of wind energy, solar power and/or energy storage, but today there are over 200.

In spite of this, the relatively scarce resources of data analytics and digital solutions companies which have been early movers in the space indicates that strategic investments and mergers and acquisitions (M&A ) are likely to continue throughout the remainder of 2018. As more asset owners seek to unlock the value of their data, the independent data analytics companies or OEMs offering fully featured digital service functionality will see increased demand and fierce competition.

OEMs have strengthened their intellectual property (IP) position for key functional capabilities of digital services. While the landscape is becoming more cluttered, the disparity in patent ownership for OEMs versus data analytics companies introduces a significant commercial risk for the latter. Key technologies which have already been patented, such as creating and using digital twins for asset performance enhancement or life extension, calculating remaining useful component life, or enhancing energy output in a simultaneously price optimal and loads minimal fashion, will create barriers to entry for many data analytics companies hoping to gain a foothold.

This IP asset disparity also creates negotiating leverage for OEMs to offer their digitally enhanced services as part of a long-term service agreement to project developers and owners, creating a hurdle for independent data analytics companies or asset management companies who have not done their homework to avoid IP infringements related to digital services.

A lack of standards also continues to hamper digital services platform development as most OEMs forge their own path without clear rules on Internet of Thigs (IoT)sensor integration or standardisation of data formats. This creates a scenario in which significant public relations and marketing resources may be required to convince the industry at large that any one platform-based solution is the preferred method.

Data security also remains a key growth barrier, which can be considered comparable in complexity to the issue of lack of standards for communication protocols and system interoperability. While IoT data security companies specific to renewables exist, and have been receiving the majority of Venture capital investment in recent months, this area still requires further definition and development as RE power generation capacity penetration increases in the overall electricity mix.

Content monetisation opportunities exist for asset owners, and even insurance companies. They are likely to see commercial benefit from partnerships with analytics companies, asset performance management companies, asset health monitoring companies, and energy trading/balancing companies, who are all data thirsty at the moment. The asset performance data can be sold or traded for services or other commercial rights, as companies with data attempt to balance the negotiating field in service agreements with companies that have a strong IP position.

Proactive asset owners, OEMs, or insurance brokers with reams of asset reliability and performance data who out-license or cross-license their data could see a total royalty income upward of US$ 673 million in recognised commercial value. This underscores the need for a data and digital content exchange to facilitate such licensing transactions.

The value of digitalisation in RE to further lower O&M costs as well as provide significant levelised cost of electricity improvement across the entire operational fleet is about to be fully recognised as more companies seek to enter the space and leverage digitally enhanced solutions to drive growth.