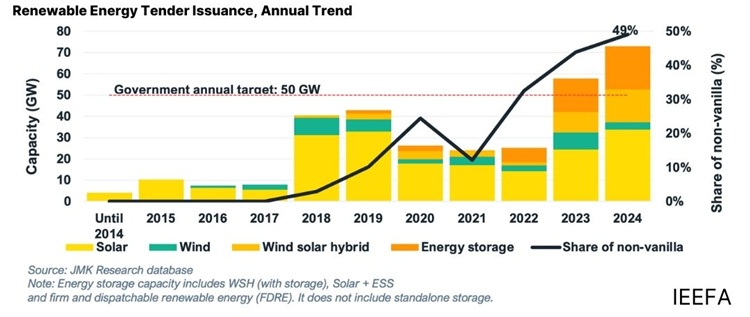

A report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics finds that India issued tenders for 73 GW of utility-scale renewable energy capacity in 2024, surpassing the Ministry of New and Renewable Energy’s (MNRE) annual target of 50 GW. Notably, nearly half of these tenders included wind-solar hybrid and battery energy storage projects, reflecting demand from energy offtakers for improved power quality.

The surge in tendering activity has introduced challenges that could slow project development and impact investor confidence. The report highlights several issues:

- Undersubscription of tenders: Around 8.5 GW of tenders were undersubscribed in 2024—five times more than in 2023—due to complex tender structures, aggressive bidding in reverse auctions, and delays in interstate transmission system (ISTS) infrastructure readiness.

- Delays in signing power sale agreements (PSAs): Over 40 GW of projects are awaiting PSA signings, with the Solar Energy Corporation of India (SECI) responsible for 30% (12 GW) of the backlog.

- Tender cancellations: From 2020 to 2024, 38.3 GW of utility-scale renewable energy capacity was cancelled, about 19% of the total issued capacity in that period. Key reasons include tender design flaws, location or technical challenges, undersubscription, and PSA delays.

The report urges authorities to address inefficiencies in the tendering process by ensuring a smooth transition from request for selection to allotment and PSA finalisation. This approach would help maintain momentum in India's renewable energy expansion.