The largely anticipated release of the GE Haliade-X has set the offshore wind industry alight with the anticipated product responses from SGRE and MHI Vestas. However, with most Chinese OEMs still between 3 and 6.7MW in nameplate rating for their offshore wind turbines, what will they do next to compete on product evolution in the Chinese and other Asian offshore markets?

The largely anticipated release of the GE Haliade-X has set the offshore wind industry alight with the anticipated product responses from SGRE and MHI Vestas. However, with most Chinese OEMs still between 3 and 6.7MW in nameplate rating for their offshore wind turbines, what will they do next to compete on product evolution in the Chinese and other Asian offshore markets?The majority of the installed capacity to date in the Chinese offshore wind market has been dominated by SGRE and in particular its SWT-4.0-130 product. The installed capacity of turbines 5.0–6.7MW from domestic Chinese OEMs has been very small by comparison at this point, but this is expected to change in the next few years.

In the meantime, the market has shifted from being Sinovel dominated back in 2013 to being SGRE dominated, with a 48% projected market share by the end of 2018, according to IntelStor™. This is a trend we expect will continue in the coming years as SGRE is set for a minimum of 1.9GW of new capacity in 2019 and 2020 alone, while most competitors lag behind with less than 800MW.

The implications of the retreat from the market by Sinovel will allow competing OEMs to potentially capitalise on the 900MW of capacity which is still under development by China Guodian Corporation, State Power Investment Corporation and China Huaneng Group.

In total, China has 11.1GW of capacity under development, including consents, with another 34.5GW in various early stages of development (i.e. pre-consent). It is noteworthy that most Chinese offshore wind project sites are around 300MW on average in size, which allows easier project siting as well as securing of a finance package compared with the project sites well above 600MW that are common in Europe.

A review of annual capacity additions analysed by IntelStor™ suggests that 2018 will see over 1.45GW of new offshore wind and 2019 should just break the 2.5GW mark. Similarly, the analysis shows 1.95GW of cumulative capacity installed as of the end of 2017 with that cumulative total reaching 3.4GW by the end of 2018 and an expected total of 7.3GW by the end of 2019. The majority of the growth in the market is coming from SGRE, Goldwind, Envision and CSIC Haizhuang.

However, the merger between Shenhua Group Corporation and China Guodian Corporation could present an opportunity for Goudian United Power (UP) to shine, as the parent company holds development rights to 1.3GW in Hebei, Shandong, Hainan and Zhejiang. While selection of the UP turbines is not guaranteed, the UP154 at 6.0MW is one of the largest domestically manufactured offshore units in the region.

As the Chinese offshore market is poised to scale up even further in the coming years, the influence of the domestic OEMs is sure to increase. Goldwind and Envision have launched new offshore wind turbines at 6.7MW and 4.5MW, respectively, in the past 12 months. Demonstration projects for both those new turbines are set for completion by the end of 2019.

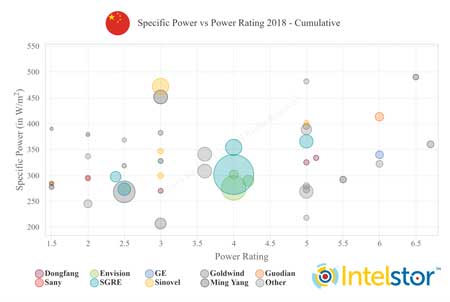

In the meantime, the vast majority of Chinese offshore wind turbines installed have been at power ratings which are at or below 4.0MW, with only demonstration projects for the 4.2–6.7MW turbines from various OEMs.

However, recent trends in the growth of nameplate rating and rotor size would suggest that the market is poised to see larger capacity turbines installed. While China is not quite ready for +10MW offshore turbines, analysis of power rating growth over time suggests that turbines in the 6–8MW range will begin to supplant the 4.0MW product offerings within the next two years.

Average power rating is set to increase from 3.67MW in 2017 to 4.17MW in 2018 with a compound annual growth rate of 12–14% for the next two to three years until another plateau close to the 6.0MW range before significantly larger turbines can be considered for the Chinese market.

Rotor size has seen a marked increase from around 80 metres in 2010 towards 140 metres in 2017. The recent trend in rotor size growth suggests that 6.0–8.0MW turbines will require a rotor in the range of 150–190 metres to remain competitive in the Chinese market beyond 2020.

Currently, average specific power of the capacity being installed in China is at 261W/m2, with the trend expected to continue for exploitation of project sites around that specific power range for the next few years. A slight uptick in the average to 264W/m2 is anticipated by 2020. A decent amount of new capacity in the specific power ranges below 250W/m2 is likely to see more buildout in a post-2020 cycle.

The race is on for the next generation in offshore wind for the Chinese market, and the Chinese OEMs are not too far behind.